Getting out of debt is an exhausting process that often requires a well thought out plan which needs to be accomplished step-by-step over a long period of time.

When you’re buried under piles of dept, sometimes it feels as though you’re drowning in a pit you can’t climb your way out of.

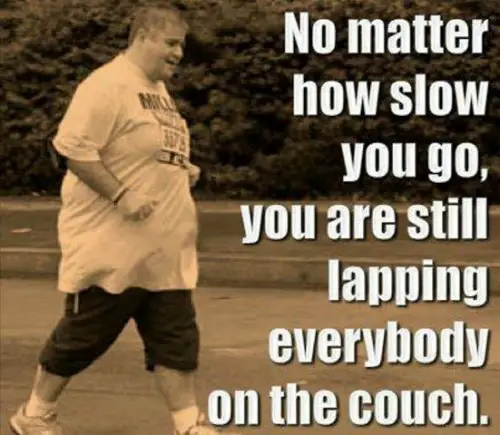

Fortunately, there are always ways to get yourself out of debt. Just as the process is similar to dieting, in many ways it can also be compared to running a marathon.

You have to know your limits, pace yourself, and keep you mind on the finish line in order to achieve your goal.

Motivation

Motivation is one of the most important aspects of running a marathon and getting out of debt. You need to want to climb out of debt.

Getting out of debt isn’t easy, so you have to keep yourself motivated and think about the long-term benefits it will have on your life. Staying motivated will make it easier to work towards paying off your debt.

Making the Commitment

It’s easy to sit back and theorize how you’re going to get out of debt, but words don’t mean anything if you never put a plan in action.

Instead of just talking about paying off your debt, make the commitment to actually pay off your debt. Once you start figuring out a budget or payment schedule, you’re committed to a goal.

Having a Plan

Having a plan is also a great idea. When you run a marathon, you want to set a training schedule so you can prepare months before the marathon date.

When you’re trying to get out of debt, you need to create a budget or plan of action so you know how you want to start attacking your mountain of debt.

Read Also: 4 Steps to a Home Budget that Works

For instance, you might want to make a budget to trim excess from your weakly spending or you might want to figure out which form of debt to tackle first.

Taking Action

Once you have the motivation to get out of debt, as well as a plan to get you started, you need to take action.

Just as a runner would start going on daily runs for practice, you need to start cutting your spending habits or saving money to put towards your debt.

This can be a huge lifestyle adjustment, but you need to forge on forward and keep with it.

Support of Friends and Family

Having the support of friends and family is a great bonus when you’re trying to get out of debt.

They not only understand the changes you’re trying to make in your life, but they’re there to cheer you on as you go about making these changes.

Sacrifice

Of course, as with anything, undertaking such a monumental life change requires sacrifice.

Marathon runners often have to sacrifice diet and time in order to train, so it makes sense that you will have to sacrifice in certain areas of your life when you want to get out of debt.

This might mean cutting a weekly trip to the movies or trying to spend less money on takeout.

Perseverance

It’s easy to want to quit when things look tough, but you need to persevere. Sometimes you just need to push yourself a little further in order to achieve your goal.

So when the going gets tough, don’t quit. Just keep on running toward that finish line because if you stop now, you won’t ever get yourself out of debt.

Avoiding Setbacks

Marathon runners know that if they stop training and practicing, they’ll face setbacks.

When you’re trying to get out of debt, even one setback could hurt your chances of paying off all your debt.

Maybe you’re out shopping and are tempted to buy a big-ticket item that you’ve always wanted.

While it may be tempting, you need to avoid needlessly wasting money that could be better spent paying down your debt.

Knowing your Limits

On the other hand, you also need to know your limit. You might want to push yourself to the max and pay as much money toward your debt as you can, but you also want to make sure that you have money for your weekly and monthly expenses.

Trying to get out of debt doesn’t mean that you have to live on next to nothing. You still want to have money for social activities.

So, be smart about making a budget, but don’t try to force it in a way that makes you even more miserable.

Reaching the Finish Line

The best thing about both running a marathon and getting out of debt is the knowledge that there’s a finish line at the end.

You know that whatever race you’re running will eventually end and that it’s only a matter of time until it’s over.

It might seem like a long road ahead of you before all your debt is gone, but it’ll happen as long as you stick to your plan.