Does the idea of an ‘Income Share Agreement’ send a cold shiver down your spine? On the face of it, you are signing away a portion of your income for a long period of time with no limitations on your earnings. On the other hand, you might not have to go into debt to fund your higher education dreams.

Income share agreements: The details and downsides

Firstly, an income share agreement is not a loan. In a traditional loan structure, a party is given a lump sum with the agreement that they will pay it back over a certain time period under certain conditions.

However, with an income share agreement, an individual is given a lump sum and agrees to pay the lender a set portion of their income for a set time period.

For example, Lender X agrees to give you $20,000 for your schooling. In return, you agree to give them 5% of your earning for the next 10 years. In 2018, graduates were earning an average $50,000 per annum, right out of college. If you never get a pay raise, then you would end up paying the lender $25,000.

However, it’s unlikely you won’t have a pay rise in ten years. If you were receiving bonuses, cost-of-living pay raises, and promotions, then you’ll likely have to pay up more at the end of ten years.

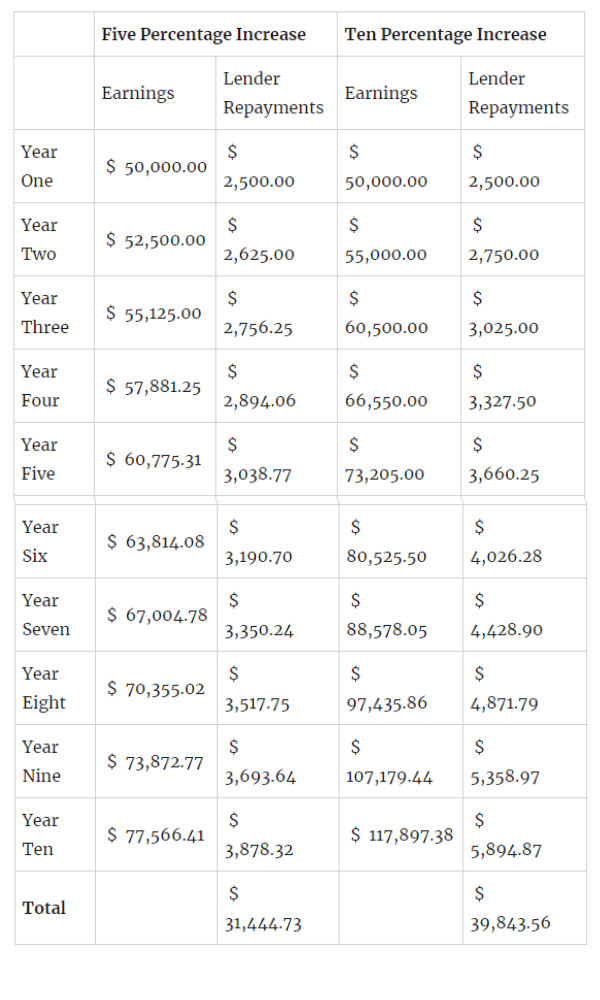

Assuming you got a five or ten percent raise year-over-year, an ISA agreement would look like this:

If you had borrowed $20,000 on a 6.8 percent student loan, then in ten years you would only repay $28,000.

But Wait, There’s Benefits

If you had taken out a $20,000 loan, then you repay $28,000. If you took up an income share agreement as above, then you could pay anywhere from $3,500 to $12,000 more. However, this assumes that you are earning consistently for ten years with pay raises and no breaks in employment.

If you took work in a lower paid profession, then you won’t be spending as much at the end of ten years even with 10 percent annual raises. However, if you struggle to find work, take a break for maternity leave, or maybe take a gap year under an income share agreement, then you won’t be required to make any payments.

If you stop earning for a few months, student loans still accrue interest and demand to be paid. However, with an income share agreement, you only pay when you are earning.

While you are at a risk of paying more for an income share agreement than if you took out a loan, you also have massive flexibility of knowing there is no debt looming over your head.

Whether you want to start a business, change careers, take a gap year, or start a family, you can do it with the confidence that you won’t have debt collectors knocking on your door.