This envelope budgeting method, also called the cash budget system, will increase your income by knocking down your expenses.

When it comes to smart ways to save money from your paycheck, this frugal envelope budget approach is a proven money management tool. In fact, using this technique, you’ll find that you can better organize and track your finances.

In a nutshell, you’ll have the peace of mind of knowing where every dollar is coming and going to keep your expenses in check and save cash.

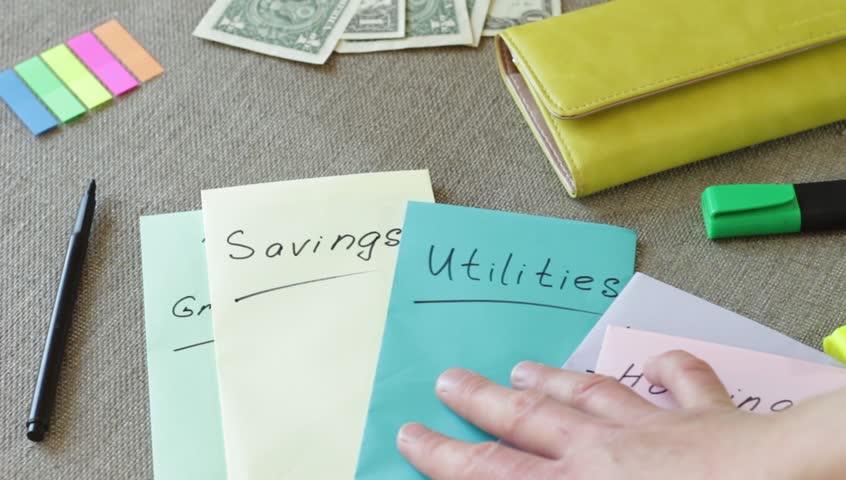

The beauty of this budget system is its simplicity. It’s a tool using just letter-sized envelopes to keep you on track with your monthly spending.

The Envelope Budgeting System’s Basics

First and foremost, you should have a basic budget blueprint put together (whether hand written or on a spreadsheet). This will be the foundation to your envelope budgeting system.

Envelope budgeting is a method of budgeting whereas you set aside cash money for a specific purpose or category in an envelope account.

Although we’re budgeting on a monthly basis, it’s best to add cash to each envelope each time you receive your paycheck.

For example, if your monthly budget blueprint allows for $50.00 per month for gifts and your get paid bi-monthly, then put $25.00 into the gift envelope each paycheck.

The beauty of this system is it forces you to “live within your means” by staying within your budget and keep you from overspending.

Read Also: Living on a Budget.

Anytime you want to make a purchase, you just look in your envelope labeled for that purchase category to see if you have the necessary cash needed.

If you have the funds, excellent – you make the purchase. If you don’t have enough money for the purchase, then you hold off buying until you have enough money set aside.

In this case, you may not be able to purchase what you want this month, but next month may be a different story as you consistently add cash to your envelope each paycheck.

Don’t forget, unspent envelopes will continue to build up cash every month, which is definitely a positive.

Another great feature you’ll love about this budgeting system is its simplicity.

You’ll know how much money you have left to spend in a given category at any time by just simply counting the cash in your envelope.

If you have the cash – great. If not, you hold off spending on a category until you accumulate the necessary cash.

Create a Cash Envelope for each Budgeted Account

Take a letter-sized envelope and write down the account name and the monthly amount you’ve budgeted for that category/account on the front of the envelope.

Do that for all of your budgeted accounts and store the envelopes in a safe place.

When it comes to your ongoing monthly bills, I’d highly recommend that you label each bill envelope with the name of the bill (ie: car payment), the amount due each month as well as the due date.

You can also sort by due date.

These due date labeled envelopes will hold priority over other accounts and keep you on track to get your bills paid.

You should also create an additional envelope for savings or debt. If your monthly net income exceeds your monthly expenses, then set aside cash into your savings envelope.

A good rule of thumb is the 10% rule where you put 10% of your net monthly income into the savings envelope to be used for savings and investments.

The 10% rule also applies if you have debt to pay down (ie: credit cards).

Simply create an account called debt reduction and place up to 10% of your net monthly income into that envelope to be used to pay down your debt.

Staying on Track and Patience

Once you’ve spent the money in a given envelope, you’re done spending for that category.

If you go shopping for clothes and exhaust the money in your clothes envelope, you can’t spend any more money in that category until you reallocate budgeted funds in your envelope.

Being patient is the key. Speaking from experience, it’s going to take you a few months to get to the point where you’re comfortable with this system.

It took me 2 to 3 months to perfect this. And what’s GREAT, is if you stick with it, it does get easier, you’ll no longer overspend, still have fun and be much happier because you’ll be living within your means (frugal living).

Beware of Credit Cards

It’s very tempting and convenient to swipe the credit or debit card to make purchases. However, this can easily cause you to lose track of your money.

I was notorious for using these cards which does cause you to overspend. Bottom line, by getting into the habit of spending cash out of your envelopes you’ll be much less prone to overspending.

Bottom line

Saving money is great. By using the cash envelope method our family budget definitely sets aside some money for extracurriculars and you should try and do so too.